Buying your first home is an exciting and significant milestone in your life. However, it can also be a daunting and overwhelming experience, especially for first-time homebuyers. In this article, we will provide a step-by-step guide to help you navigate the process of buying your first home.

Step 1: Determine Your Budget

Before you start looking for a home, it’s essential to determine your budget. Here are some factors to consider:

- Income: Calculate your monthly income and any other sources of income you may have.

- Savings: Determine how much you have saved for a down payment, closing costs, and other expenses.

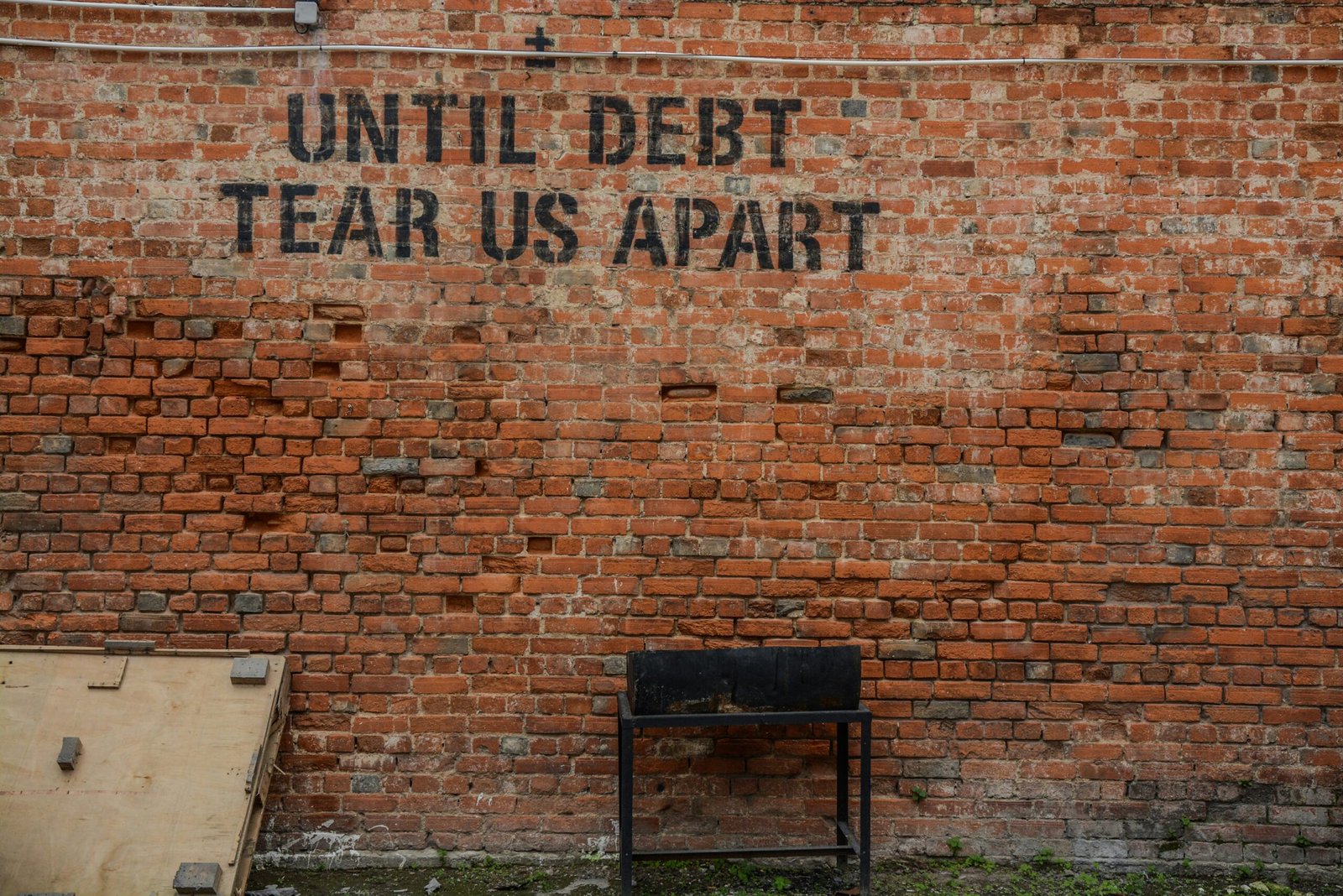

- Debt: Consider your outstanding debts, such as credit cards, student loans, and car loans.

- Credit score: Check your credit score to determine how it may affect your mortgage interest rate.

Step 2: Get Pre-Approved for a Mortgage

Once you have determined your budget, it’s time to get pre-approved for a mortgage. Here’s what you need to do:

- Contact a lender: Reach out to a lender or a mortgage broker to discuss your options.

- Provide financial documents: Submit your financial documents, such as pay stubs, bank statements, and tax returns.

- Receive a pre-approval letter: The lender will provide you with a pre-approval letter stating the amount you are eligible to borrow.

Step 3: Identify Your Home Needs and Wants

Now that you have a budget and a pre-approval letter, it’s time to think about what you need and want in a home. Here are some factors to consider:

- Location: Think about the location you want to live in, including the neighborhood, city, and state.

- Size and layout: Consider the size and layout of the home, including the number of bedrooms and bathrooms.

- Amenities: Think about the amenities you want, such as a backyard, pool, or community garden.

- Type of property: Consider the type of property you want, such as a single-family home, condo, or townhouse.

Step 4: Research Neighborhoods and Communities

Once you have identified your home needs and wants, it’s time to research neighborhoods and communities. Here are some factors to consider:

- School districts: Research the local school districts and their reputation.

- Crime rates: Look into the crime rates in the area and any safety concerns.

- Transportation: Consider the transportation options in the area, including public transportation and parking.

- Amenities: Research the local amenities, such as parks, restaurants, and shopping centers.

Step 5: Work with a Real Estate Agent

Now that you have researched neighborhoods and communities, it’s time to work with a real estate agent. Here’s what you need to do:

- Find an agent: Research local real estate agents and find one who is knowledgeable about the area and type of property you are looking for.

- Discuss your needs and wants: Share your home needs and wants with the agent, and ask for their advice and guidance.

- View homes: The agent will show you homes that meet your criteria, and you can provide feedback on each property.

Step 6: Make an Offer

Once you have found a home you like, it’s time to make an offer. Here’s what you need to do:

- Determine your offer price: Based on the market value of the home and your budget, determine your offer price.

- Create an offer package: The agent will help you create an offer package that includes the price, contingencies, and other terms.

- Submit the offer: The agent will submit the offer to the seller, and you will wait to hear back.

Step 7: Inspect and Appraise the Property

Once your offer is accepted, it’s time to inspect and appraise the property. Here’s what you need to do:

- Hire a home inspector: Hire a home inspector to examine the property and identify any potential issues.

- Review the inspection report: Review the inspection report and negotiate with the seller to address any issues.

- Appraise the property: The lender will appraise the property to ensure it is worth the sale price.

Step 8: Close on the Property

Finally, it’s time to close on the property. Here’s what you need to do:

- Review the closing documents: Review the closing documents, including the title report and loan documents.

- Attend the closing meeting: Attend the closing meeting with the seller, agent, and lender to sign the documents.

- Get the keys: Once the documents are signed, you will receive the keys to your new home!

Conclusion

Buying your first home is a significant milestone, and it requires careful planning and preparation. By following these steps, you can navigate the process with confidence and find your dream home. Remember to:

- Determine your budget and get pre-approved for a mortgage

- Identify your home needs and wants

- Research neighborhoods and communities

- Work with a real estate agent

- Make an offer and negotiate the terms

- Inspect and appraise the property

- Close on the property and get the keys!

We hope this guide has been helpful in your journey to buying your first home. Good luck!